Mergers and Acquisitions

KARL MAYER stands for innovation, quality and reliability in textile machine development and manufacturing. In mid-2020, we realised another major step towards becoming a comprehensive textile and clothing solution provider with the acquisition of flat knitting machine manufacturer STOLL. We intend to develop further , diversify more by making additional acquisitions , and continue our success story... Beyond textile.

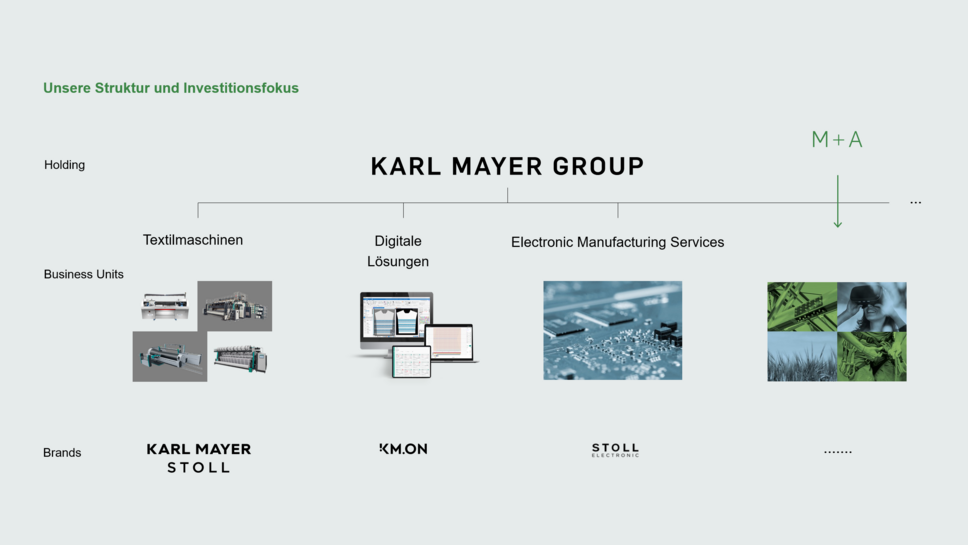

OUR GROWTH AND DIVERSIFICATION STRATEGY

The organisation into business units helps us to put customer benefit at the centre of our efforts and to live entrepreneurship.

With the acquisition of STOLL in 2020, we now have an additional textile manufacturing technology. STOLL has been integrated as an independent business unit into our group, will keep its strong brand name and is ready for further growth.

Our aim of continued inorganic growth goes beyond the limits of the textile world. We are interested in companies that are leading in their respective field and ideally have strong brands. The technologies should match or complement our expertise. Also, it is important that we have the same corporate culture and values.

OUR FOCUS

We are interested in investing in companies, carve-outs, spin-offs preferably supporting succession situations in family businesses.

The following search spectrum are of particular interest to us:

INDUSTRY: Capital goods and services

FUTURE: Future-focused fields sustainability and circular economy.

Of course, we will also continue to be interested in opportunities for expanding our spectrum in the area of TEXTILE. We are particularly interested in family businesses that share our values and corporate culture.

START-UP: Start-ups, once beyond the establishment phase, are also a good match for us.

HOW WE SEE OURSELVES

The KARL MAYER GROUP is a family-owned business with 3.100 employees worldwide.

We produce and develop where our customers business is. A robust strategy that aims for sustainable and long-term success, coupled with a strong financial background, puts us in the position to shape markets.

OUR AREAS OF EXPERTISE

Uncomplicated processes involving a small group of stakeholders guarantee prompt decision-making even in complicated situations.

For us, transaction security means:

We use our own funds for financing and benefit from clear, well-organised structures and flat hierarchies.

The essential expertise to handle merger and acquisition processes, we have inhouse. We will only involve external expertise in later stages when transaction-specific details become important.

INTEGRATION

A sensitive approach to post-merger integration is important to us.

We use the term synergy in the actual sense of the word: cooperation. We expect to learn from each other, combine our areas of expertise, and jointly develop and grow.

We allow plenty of time for important changes of direction, we take as long as it needs, we prepare ourselves well and act with prudence. Our financial independence puts us in the comfortable position of having to consider only our own corporate aims.

Trust is the beginning of everything

Direct, discrete and confidential communication"

"M+A" topics are pursued by our own team. One project – one face.